“Nowadays people know the price of all things and know the value of none,” admonished Oscar Wilde from the pages of his novel The Portrait of Dorian Gray. If he were still on this planet, he would probably have to revise this sentence, counted today among the aphorisms of the Irish author. In fact, by purchasing a wide variety of goods online (vacations, appliances, theatre tickets, etc.) consumers have learned that the price of those products and services can vary depending on the marketplace in which they search and the moment of purchase. Savvy users have even realized that clearing their browser history before the purchase in some cases could help drive down the price of the desired product. Resetting one’s search cookies makes it more difficult to analyze buying habits, tastes and needs, and can limit some profiling practices that are not always conducted in compliance with regulations.

However, there are still many companies that trade online and have not, to date, implemented dynamic pricing techniques that allow them to increase their customer base and revenues in markets characterized by elastic demand. (see our previous article on the elasticity of demand).

It’s not easy to decide to start applying this kind of strategies and to find the right tools to support this kind of choice, whether it’s Macro recorded on Excel, strategic consulting from specialized companies or real dynamic pricing software based on Artificial Intelligence.

What are the characteristics to take into consideration when deciding whether to apply dynamic pricing logic to one’s products? What are the variables that impact demand? How is it possible to build a dynamic pricing algorithm to sell a good? Applying mathematics, statistics and artificial intelligence to pricing can radically change the way you interpret sales data and build your pricing offer and increase the competitiveness of your offer, especially in today’s rapidly evolving market.

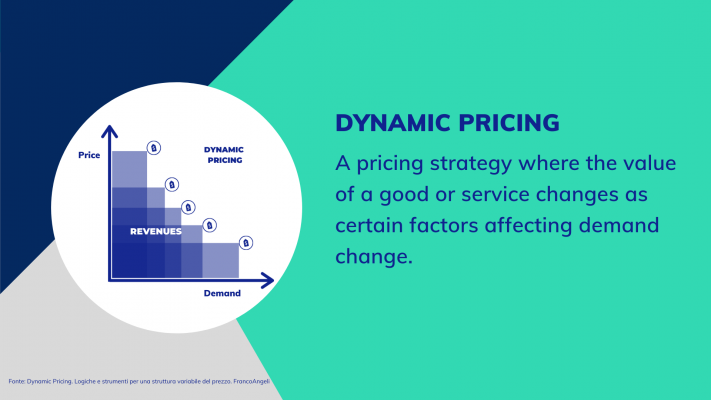

Dynamic pricing is a very broad concept. Any strategy to change the price of an asset can be brought under this inflated definition. To clear the field of possible confusion, it is necessary to make some distinctions to begin to identify different types of dynamic pricing applications.

According to Sheryl E. Kimes, university professor and recognized expert in Yield Management, an efficient application of Revenue Management strategies is facilitated by the coexistence of certain market conditions. Specifically, the key assumptions are:

- The perishability of the product (or service) being sold;

- The possibility of early sale;

- The possibility of market segmentation;

- Low marginal costs of sale;

- High marginal costs of production;

- High fluctuation of demand;

- High predictability of the question.

Dynamic pricing, the variables

Ascertained the co-presence of various elements over indicated, in which way the modalities according to which the discrimination of the price happens can be differentiated? In general, it is possible to trace them back to three types based on the variables taken into consideration:

- Object to sale: when the main variables that drive price changes are the demand for that good, the time of purchase, competitors’ prices and inventory.

- Purchase profile: when the primary variables driving price changes are the language of navigation, the geographic location of the buyer, the device used, and all characteristics attributable to the buyer if they are available (age, gender, past purchases […]).

- A combination of the above.

In addition to how discrimination is performed, it is also possible to distinguish the tool supporting it, for example: an algorithm that analyzes sales histories; an algorithm that compares competitor prices; an algorithm that checks the user profile; a table of variable rates, chosen and applied without a real calculation logic; offers limited to time windows (e.g. last minute) or a combination of two or more of the listed tools.

Finally, a final discriminating factor is a frequency with which the price is to fluctuate, which can change

- when certain conditions that impact demand change and regardless of the time that has elapsed since the last fluctuation;

- on reaching certain sales goals;

- according to predetermined time frames (daily, hourly…).

The basics of Dynamic Pricing

The concept of variable price is not a recent invention, on the contrary. Discounts and promotions, with more or less scientific reasoning at the base, have always characterized the free market and the consumer is now accustomed to dealing with them as well as being able to recognize some of the logic behind these dynamics.

For example, the average consumer is widely aware of the fact that

– under certain conditions (time of day, day, time of year, etc.) the price can fall or rise: for example, at the supermarket the price of sushi will fall sharply close to the evening closing time while, in the fruit and vegetable department, the price of fruit and vegetables can rise when natural disasters limit supply;

– by purchasing a product in combination with others or in certain quantities, it is possible to obtain discounts: as in the classic case of 3×2 offers;

– by adhering to store loyalty programs, one can have access to a series of benefits and discounts reserved for members: this is the case with supermarket loyalty cards, airline point collections or secret offers reserved for registered users of online tourism portals.

The price of goods and services is already in many cases “dynamic”, what distinguishes these policies from the variation of a price determined by the use of a real algorithm is the different level of optimization of results and the possibility of a continuously updated analysis of the market.

Dynamic Pricing, some questions

For example, a trader who is struggling to sell a product can try to stimulate demand with a lower price, calculating the maximum amount of discount to be applied to the list value while safeguarding a minimum marginality to reach the break-even point. This way of operating does not allow, in the absence of supporting algorithms, to take into account in a precise manner various factors:

– How sales evolve

– What is the best price to apply at each moment of the sale;

– How competitors are behaving;

– What clients think of the product and the price.

Constantly monitoring these aspects can make the difference between a cost-effective merchant and one who manages to optimize the revenues of his business.

Does this mean that those who decide to rely on dynamic pricing algorithms must abandon periodic discounts, loyalty cards, last-minute deals and all the policies mentioned previously? Not necessarily, because often the right combination of these solutions is decisive for the success of commercial activities in terms of image, revenue and number of buyers.

Dynamic pricing, why to use it

Choosing to adopt a dynamic pricing strategy can go together with the decision to reduce the number of promotions applied and yet maintain, for example, static preferential prices for certain categories of buyers. The least effective policies, which should be removed, are those that involve systematic price increases or decreases without making an effort to understand, on a case-by-case basis, what factors govern the fluctuation in demand. For example, always increasing the price of a hotel room by the same amount in high season is not correct. Not all high seasons have the same characteristics and in some cases, the price increase could be even higher while in others it should be lower (for example, if bad weather should limit tourist demand for that area).