The pricing strategy of a product or service can be related to two main factors: internal or external to the business.

Internal factors normally affecting the pricing strategy are: marketing objectives, cover the costs and generate profit. While, the external factors, are related to the demand analysis, the competitive scenario, the exchange rate and the regulations in force.

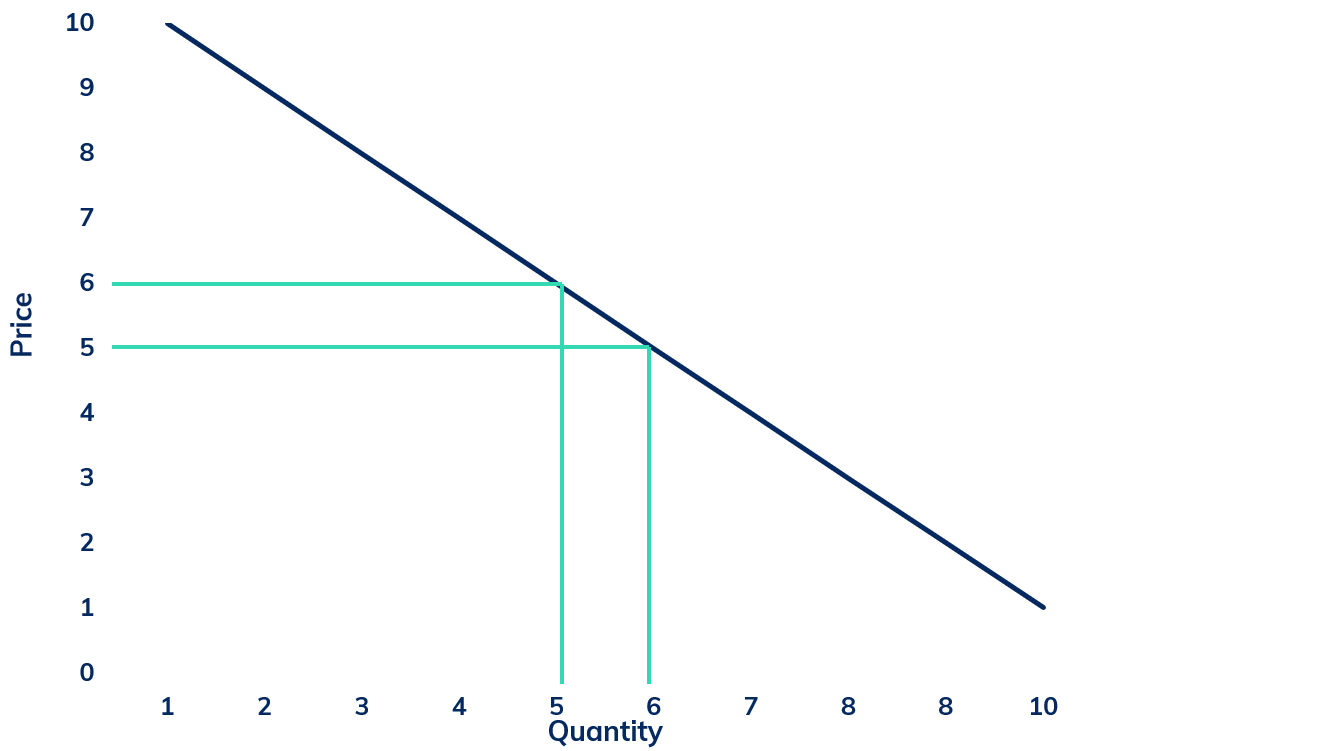

The analysis of demand is the purchased quantity of a product related to many variables such as consumers income, consumers needs and preferences, expectation, price of the product, substitute and complementary product and the price elasticity of demand. The last one in particular allows to understand the change in the quantity purchased of a product in relation to its price changes, a very important variable that often is not adequately taken into consideration.

The price elasticity of demand measures the sensitivity of the quantity demanded to changes in the price, and it is a valuable information to decide your pricing strategy.

The price elasticity of demand is calculated as follow:

ε_p=(ΔQ/Q)/(Δp/p)

The elasticity value depend on the type of product or service:

- ε_p<0 : general goods, for which if the price rises the quantity purchased decrease, following the demand;

- ε_p=0 : Giffen good, a product that people consume more of as the price rises;

- ε_p>0 : Veblen effect goods, where consumers purchase the higher-priced goods whereas similar low-priced substitute are available, normally luxury product.

When a change in price of 1% leads to a demand change greater than 1% (positive or negative) the demand is elastic, that means consumers are sensitive to price changes. While if a change in price leads to a change in demand lower than 1% we talk about inelastic demand, where consumers are not really influenced by price in purchasing choices. Finally if a change in price of 1% lead to a change in demand of 1% we talk about unitary elasticity.

There are other two borderline cases, mostly theoretical, when the demand is perfectly elastic or perfectly inelastic. In the first case the change in price of 1% leads to an infinite demand; while in the second case a price changes of 1% do not change the quantity purchased, it means the demand does not respond to price, at all.

The price elasticity of demand value allows to have a reliable economic indicator to decide the best price strategy.

Products and services with an absolute elasticity value of 1 refers to unitary elasticity, whereas the proportion in change of sales is equal to proportion of sale in price. However this case is more theoretical than real in economy, because would be that a 10% increase of the price correspond to a 10% increase of purchase. The same difficulty is when we talk about perfect elastic or inelastic demand.

When the elasticity is major than 1 in absolute value we are speaking about elastic goods, the purchase quantity is more than proportional to the price change. For example, a 5% decrease in price, increase the purchased quantity of more than 5%. Is the case of durable and non durable goods and of those products or services that have a large number of substitute goods. In this case, price is the major factor affecting the demand, where a small price increase leads consumers to buy another substitute product and vice versa. For these markets, choosing the right pricing strategy become fundamental, due to the strong reactivity of demand. Not considering or estimating incorrectly the price elasticity of demand can lead to low profit decision.

Finally, when the elasticity has an absolute value between 0 and 1, we are speaking about inelastic products, so for example, a price increase of 10% correspond a purchase decrease of 10%. In this case, consumers are unresponsive to price changes, for this reasons a dynamic pricing strategy or a rise in price can be the winning strategy. Vice versa, promotional discounts to increase sales volume won’t be the right choice. Inelastic goods are, for example, pharmaceutical, luxury automotive, energy sector, or oil. In this last case, a price increase of 0,10€ per litre, entails a less than proportional change in purchased quantity and in general, a 6% to 9% increase in revenues.

Wh is important to estimate elasticity?

Summarizing, an accurate evaluation of the elasticity and a correct interpretation represent key factors for any companies in terms of pricing strategy of products and services. The price elasticity of demand measurement allows to know the consumers sensitivity to price changes, in order to apply an effective price strategy and estimate the weight of the price in purchase choices.

Knowing this data and knowing how to analyse them, together with the right pricing strategy are the three fundamental factors that you need to know nowadays to be competitive on the market e generate profit.