Three main methodologies can be used to determine the price at which a good or service should be offered in the market, which in turn can be grouped into two macro-approaches, one demand-based and the other market-based. The market-based method takes the form of competitor-based pricing, while demand-based approaches include cost-based pricing and value-based pricing.

The latter technique, which is more complex than the previous ones, but also more profitable, is characterised by the choice to define prices according to consumers’ willingness to pay and the value that customers attribute to the good or service in question.

This value can be identified using three approaches:

- Management-based method: the determination of value is measured through EVC (economic value to consumer) and this measurement is entrusted to management. Concretely, it consists in calculating the economic value of one’s own product given by the difference between costs and benefits for the customer in comparison with rival products.

- Fishbein technique: the value of the product is calculated as a weighted average of the values attributed to the individual components or brands of the product, and the value of the weighting depends on the level of importance that each attribute has on the overall product.

- Conjoint Analysis: the calculation of the value that consumers attribute to the product is derived from the results obtained through interviews, questionnaires and market surveys that aim to identify price sensitivity, the value attributed to the good by consumers and the willingness to pay. Well-known examples of this approach are the Gabor-Granger model and the Van Westendorp model. The former reveals the price points for which the probability of purchase falls significantly and the latter allows the identification of the perception of customer value through the identification of four pivotal values: the minimum price, the maximum price, the threshold price and the indifference price.

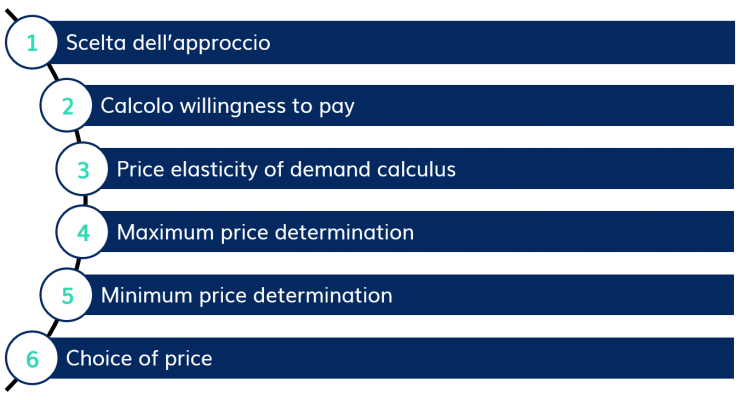

Among these three approaches, the one most widely used by companies in the Conjoint Analysis, because of the possibility of knowing and analysing the perception of the value of the good or service clearly and effectively. Moreover, the distinctive element of this analysis is that, while in the first two techniques the determination of value is entrusted to internal evaluations and estimates of the company itself, the conjoint analysis allows to know the customer’s point of view, his willingness to pay and his price elasticity.

Pros of the approach

Thus, the definition of the price based on the values obtained through these approaches will lead the company to know the willingness-to-pay of the consumers, the price level beyond which it is not convenient to go and the sensitivity of the customers to price changes. This is one of the main advantages of such a pricing technique that allows having in hand the necessary elements to maximise the demand curve.

The choice of putting the consumer and his preferences in a central position in the pricing phase denotes strong attention to his needs, to the possible evolution of his tastes and the preferences of the new generations. Such an approach increases the company’s flexibility and allows it to seize new market opportunities very quickly.

A further advantage is that conducting interviews, surveys or market research to determine the price of a product, as well as providing valuable information to the company about its customers, is often considered by consumers as an added value because it denotes attention to their opinion and preferences. Therefore, in addition to being a pricing technique, it becomes a service for the customer and an element to strengthen customer loyalty.

Value-based cons

However, like any methodology, value-based pricing has limitations in its application. The main one is certainly related to the high commitment of time and resources required to reach the expected result. Often, as we have seen, surveys or interviews are the most used methodologies, but, of course, these need a lot of time to collect the answers and the use of economic resources for correct implementation and analysis.

Finally, a final negative aspect of this approach is that it is an empirical analysis, which is not completely scientific. In fact, building a dataset on consumers’ opinions and preferences makes it difficult to establish the correctness of the answers. This limitation can be partly overcome by achieving a high sample size and by identifying and analysing outliers.

To conclude, one of the areas in which the application of this method is most effective is that of products with high added value. Think of products where the brand has an important intangible value, such as Apple, or products that have a large and loyal user base, such as Levi’s. Value-based pricing is also often used to establish the value of luxury goods. What emerges, in general, is the transversality of this technique and the ability to provide as an output the identification of an optimal price range for one’s own good or service.