Increase the marginality has always been the main goal of every company. And the strategies that companies adopt to increase their profit margins are different, from increasing production volumes to reducing the incidence of internal management costs with optimisation of production or management lines, or even strategies based on price increases and repositioning in the market.

In most cases, the difficulty in pursuing the expected growth derives from the fact that one tries to analyse one’s own data and monitor the trends of the various KPIs through tools and models that are not adapted to the evolution that the market now requires.

The complexity of data, the heterogeneity of sources and the dynamism of the markets makes an AI-driven approach to data analysis increasingly necessary. This is demonstrated, for example, in the field of pricing, especially in all those businesses where the gross list price leads to a netlist price that causes a silent erosion of margins and a Price Waterfall.

The analysis of the Price Waterfall supplies some indications on the goodness of the single prices practised and consequently allows to identify the prices that generate the greater dispersions. The difficulty is in analyzing correctly and with the right supports every step of the waterfall to be able to intervene to the right moment and to continue to maximize the own margins.

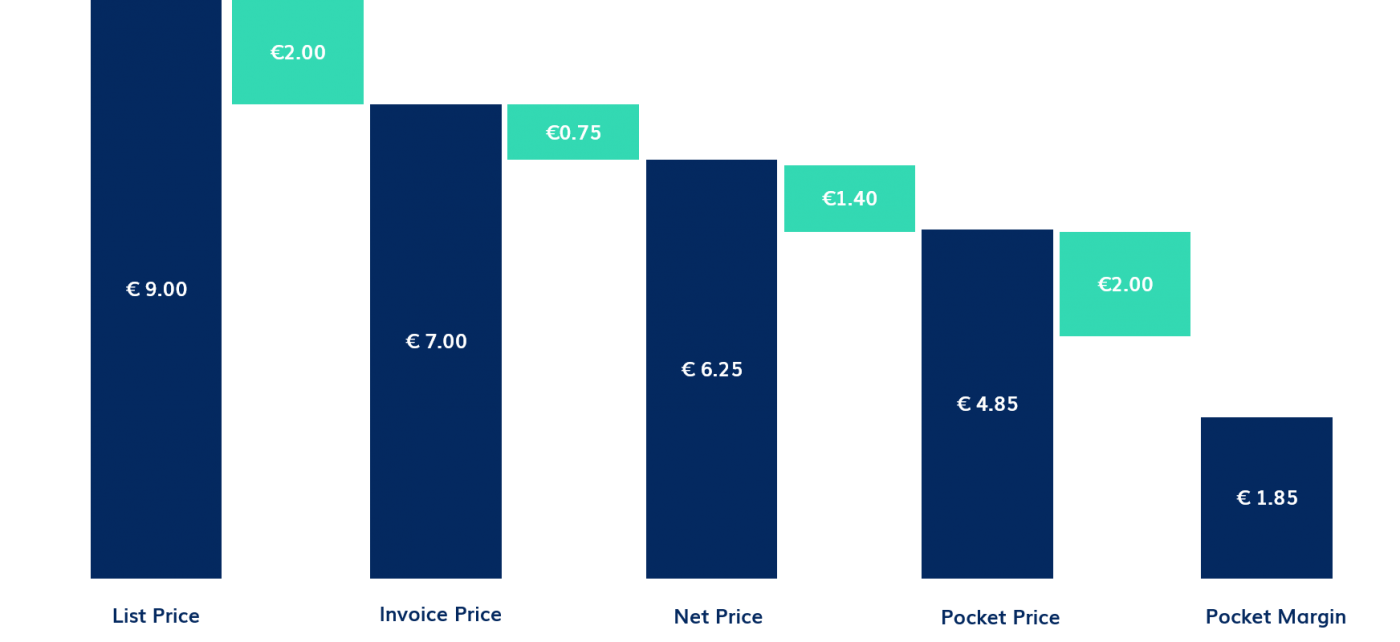

In general, the Price Waterfall can be represented with a structure like that one in the following image.

- Gross list price: the price that appears in a list or catalogue.

- Invoice price: the price that appears on the invoice. Off-invoice adjustments include discounts, sales promotions.

- Net price: the price that includes discounts made outside the invoice. Service cost adjustments include transport costs, returns and payment terms.

- Pocket price: the price net of discounts and premiums, which therefore includes the cost of the service and is the most used during the sale.

- Pocket margin: the net margin deriving from the pocket price.

Moreover, the loss of marginality often occurs in cases where concessions or sales licenses are defined, which reduce profits without giving the possibility to see concretely which factors influence the profitability of the product and pricing. The loss of margins can occur in various forms, through promotions, discounts, other price concessions, off-bill incentives, sales promotions and service costs.

But, at an overall level, artificial intelligence as a support to the analysis of the effects deriving from the pricing choices adopted allows to identify exactly where the margins are eroded the most and to acquire the speed of action and reactivity necessary to define the action to be taken to increase the margin percentage.