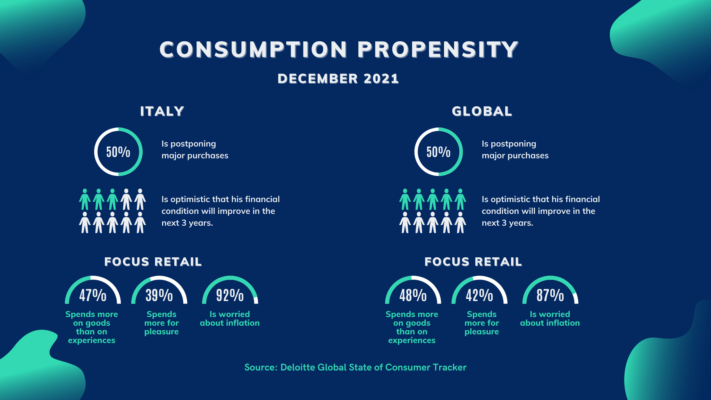

According to data recently shared by ISTAT, in 2021, after the decline in 2020 (-0.2%), consumer prices returned to grow on average for the year (+1.9%), recording the largest increase since 2012. The driver of price increases was identified as the trend in energy prices (+14.1%), which fell by 8.4% in 2020. According to the Global State of the Consumer Tracker, in the last period, Italians are mainly worried about economic issues, a trend that has become more pronounced after the recent summer season.

Retail 2022, the research

It is therefore not difficult to hypothesise that the post-pandemic consumer has seen and will continue to see a revision of priorities that will be reflected in daily life and in the choice of how and how much to spend. In general, over the last few months, 61% of Italians have felt a constant sense of uncertainty, a factor that has certainly affected their propensity to save and will also affect their consumer choices in the coming months. The fear of inflation and price growth is not only an issue that affects Italy, but is shared by most of the countries involved in the analysis, with percentages even higher than those of Italy: USA (72%), France (75%), Germany (76%), Spain (83%).

However, the third vaccination campaign and the introduction of the Super Green Pass have led to a renewed sense of security in line with consumers’ desire to seek more live experiences (59%) than digital device mediated experiences, as has been the case over the past 12 months.

Retail 2022, new habits and challenges for the sector

Over the past year, Italian consumers have become accustomed to buying online, but there are still some categories for which they remain primarily tied to in-store purchases, such as grocery (71%), pharmaceuticals (69%), apparel (65%), furniture and furnishings (51%) and household products (46%).

In this context, retailers face three major challenges:

1. Management complexity: very large assortments and a high number of shops

2. Customer behaviour: understanding how “price” influences purchasing decisions

3. Performance and profitability: predicting the impact of price changes on consumption

To address these challenges, at the heart of it all is the fact that prices and retail offerings have limited validity due to the inherent variables of the market (competition and customer preferences) and the inventory (listing/delisting of items, price changes by suppliers), so any activity regarding price choices in retail must be considered dynamically and not a one-off activity took based on data analysed quarterly or every 6 months.

Retail 2022, the role of technology

Let’s consider that for 10,000 items there are 20×10 high to the 12th possible price combinations, with a variety of related factors, such as:

1. Competitor price

2. Promotional percentage

3. Seasonality

4. Weather

5. Cannibalising alternative products

6. Branding

7. Location

8. Reputation

That’s why it’s so important to use software that enables retailers to receive real-time information about buying behaviour and demand variability (actual sales + lost sales) and to focus on indicators that help managers predict sales trends and manage the business to maximise profit, but with a sustainable focus on optimising costs, resources and waste. To do this, retailers need to consider both strategic elements, first and foremost their brand positioning, and the product attributes themselves to address all three challenges and turn them into opportunities and an advantage over their competitors. Premoneo supports companies in optimising shelf prices through a precise understanding of customer behaviour and the commercial role map of individual product categories, resulting in increased profitability.