The Information & Communications Technology (ICT) market will close 2021 with an expenditure of 34.4 billion euros, an increase of 4.1% compared to 2020: this is what emerges from the research carried out by Assintel – National Association of ICT and Digital Companies of which Premoneo is a member since 2020 – together with the independent research company IDC Italy. The ICT market includes all the technologies concerning integrated telecommunication systems, computers, audio-video technologies and related software, which allow users to create, store and exchange information, obviously including Premoneo’s Artificial Intelligence technologies.

ICT and the pandemic push

As underlined by the research, two out of three companies in Europe proved to be unprepared, also from a technological point of view, to face the consequences of a health emergency such as this one, which has raised some crucial issues such as remote working, security in sharing data with the external environment, the need to implement new sales channels and the ability to adapt their processes to the new context.

In 42% of companies overall ICT spending post covid has remained unchanged, but has been directed on specific projects to support activities during the crisis, while 9% of companies have increased spending to develop innovative projects and another 3%, while reducing total spending, continued to invest on innovative projects.

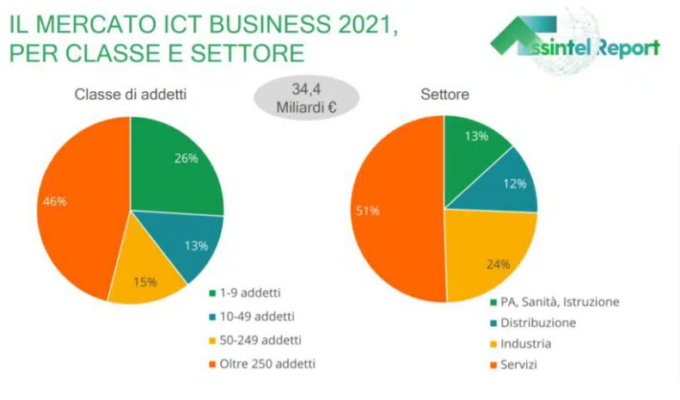

Large companies (over 250 employees) invested the most (46% of the total), followed by SMEs (with fewer than 10 employees), which accounted for 26% of total spending. More than half of investment (51%) was concentrated in service companies, followed by manufacturing companies (24%), PA, health and education (13%) and companies in distribution (12%).

ICT, spending forecasts

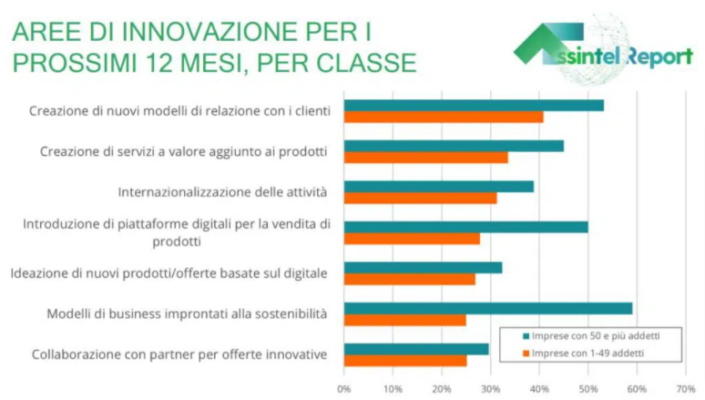

Also, the Report tells how in the next months the expense of the companies will be directed mainly to the search of new models of interaction with the customers, to the creation of services to added value to the products and the internationalization of the activities.

For all areas analyzed by the research, spending is higher in companies with 50 or more employees, while it is lower in smaller companies.

Interesting, however, is the figure for spending on business models geared towards sustainability, in which the investment planned by small companies is about half that planned by companies with 50 employees or more.

The real brake on innovation and the adoption of new technologies within companies seems to be the lack of skills in this area within companies. From the research, only 28% believe they have a good culture of innovation and sufficient digital skills, while 34% believe they have an adequate culture of innovation but lack the necessary digital skills, 22% say they need to improve in both areas, and only 16% believe they have the right digital skills but not enough innovation culture. The cultural unknown also remains strong: 39% of the companies analyzed report a persistent lack of interest and culture of innovation on the part of top management or corporate ownership, mirroring a segment of SMEs that needs a change of vision.

ICT, the impact of PNRR

For more than half of Italian companies, the National Plan for Recovery and Resilience will have a positive impact on their development and the economic recovery of the country. This is because the main obstacle to innovation – for 45% of companies – turns out to be a general lack of economic and financial resources to invest in digitization projects.

“We won’t get another opportunity like this one, unique. Assintel is ready to make ALL-IN, investing all its resources to contribute to the Digitization and Innovation of the economic system of the country,” comments Paola Generali, President of Assintel.

A big question mark remains, however, about the accessibility of funds made available to the PNRR by small and medium-sized enterprises in the sector.

ICT, interest in transformation models based on machine learning and artificial intelligence

As emerged from the research, machine learning algorithms and artificial intelligence applications are reshaping the business world. The ability to leverage data, inside and outside the corporate perimeter, is proving to be an essential competitive advantage to become “intelligent enterprises” and thrive in the data economy. Being an Intelligent Enterprise requires the careful integration of people, processes and technologies, from data management platforms to Big Data. According to IDC, by 2023, one in four enterprises will use real-time analytics to drive decisions at both strategic and operational levels, relying on applications and processes “augmented” with machine learning and artificial intelligence to achieve new levels of dynamism and adaptability.

The introduction of artificial intelligence, augmented intelligence and more evolved and flexible forms of automation will necessarily have an impact on some business processes, think especially of support functions, front-end management and production, as well as the definition of the offer based on the needs of the individual customer.

It is precisely in this context that the solutions we develop for our customers to support the optimization of business processes are inserted. Schedule a meeting with our team to understand how we can help your company in the digitization of pricing, forecasting and segmentation activities.