In 2022, online purchases by Italians will increase by 14% compared to 2021, reaching €50 billion. Of this total, €40 billion will come from products (up 10%) and €11.9 billion from services, with an even more positive trend (+28%) and confirmation of the signs of recovery already highlighted last year. This was announced during the 17th edition of Netcomm Forum, the reference event for the digital world on the evolution of e-commerce, digital retail and business innovation.

According to the latest survey by the eCommerce B2C Observatory Netcomm – School of Management of Politecnico di Milano , in products the more mature sectors are slowing down their growth path (Clothing +10% and IT & Consumer Electronics +7%), while Food&Grocery is confirmed as the most dynamic sector also in 2022, +17% year on year. In services, after the slump linked to the measures restricting mobility in the last two years, growth is back, thanks mainly to the recovery in tourist travel (+33%) and the return to events (online purchases in Other Services are up 35%).

Online penetration of total retail purchases is 11%, in line with 2021. The smartphone is confirmed as the preferred device for making online purchases: in 2022, 55% of the e-commerce value will pass through this channel, the same as a year ago.

E-commerce, the evolution of the Italian market

As every year, Casaleggio Associati has recently published its report Ecommerce in Italy 2022. According to Casaleggio, in the first nine months of 2021, almost 7 thousand companies declared bankruptcy (+43.6% year-on-year, but 16% lower than pre-bankruptcy). New business openings also decreased in the first months of 2021. The average spend for Italian online consumers has now grown to €1,608 over the year, but the attractiveness of foreign sites is still preponderant: 67% of users have bought online from foreign sites and almost all have bought through marketplaces: 95% of Amazon, 46% on eBay (down from 52% the previous year) and 45% on Zalando.

E-commerce, the focus on margins

Despite the significant growth of e-commerce in Italy, only for less than 15% of companies do more than 1% of their turnover come from the online channel. The report confirms that at the moment the Italian online market is still coming to terms with the evolution of sales methods and channels, and it is companies from beyond the Alps that are taking advantage of this, as they can easily reach Italian users. It is estimated that this transformation will cause Italian retailers to lose €3.7 billion over the next four years, partly due to inflation and margin squeeze. A great leap forward has certainly been made in terms of infrastructure; in fact, 75% of all broadband lines have reached speeds of 30 Mbit/s or more44 improving access to multimedia content to support sales. In Italy, online penetration among the population (aged 2 and over) reached 76.3% in January 2022 (+1.4% compared to the previous year) with 45 million unique monthly users and an increase of 300 thousand. A sign that brings back to normal the growth that in the previous year with the lockdown had seen 3.2 million new internet users. According to Casaleggio’s estimates, the sale of products slows down, with growth in absolute value returning to pre-Covid levels (+10%), while services are confirmed to be recovering (+28%), although still far from the pre-pandemic data.

E-commerce and retail, with the help of pricing management software

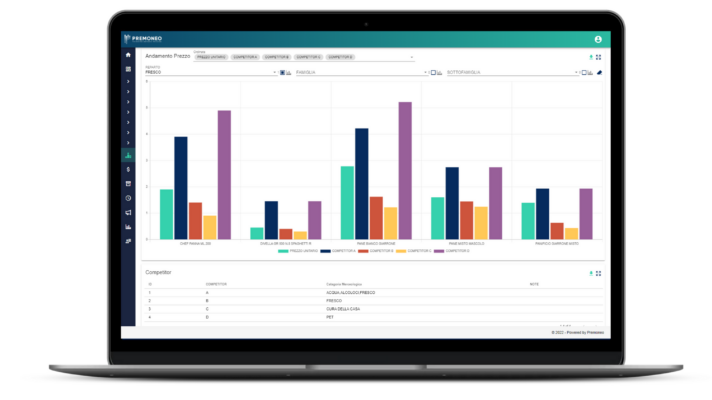

During the Netcomm Forum, we, the Premoneo team, together with Vedrai, had the opportunity to talk with many retailers and etailers, collecting their considerations about the support that technology and artificial intelligence can offer them. One of the main issues that emerged from these discussions was the need to find tools that allow supply to be adapted to changing demand and supply costs to maintain margins.

Monitoring competitors’ prices and understanding whether their pricing is in line with the market is another key aspect of management’s activities, as well as supporting the digitization of certain processes that are easier to automate, to devote more time and resources to strategic activities with high added value.

These are all aspects that the customized pricing management software we develop for retailers manages to meet, thanks also to the demand forecasting activities, carried out thanks to forecasting algorithms, which allow retailers to improve their sourcing and warehouse management activities. Schedule a demo of our retail software here.