In 2022, as companies in the major markets become increasingly digitalised, the benefits for insurers as well, in terms of increased profitability and optimised decision-making, using artificial intelligence technologies, are indisputable. The use of sophisticated algorithms to analyse the large amounts of data available to companies makes it possible to intercept new insurance needs and to revise traditional business models, making them more efficient – in terms of cost savings for the end-user and increased profitability margins for companies – and more responsive to customers’ demands for advanced services.

In the current landscape, the use of AI in insurance has a good penetration in the online purchasing process, in consulting activities, in the personalisation of the offer and the definition of the insurance premium, but it is also highly widespread in claims management and fraud prevention. The use of artificial intelligence-based technologies ensures greater efficiency throughout the insurance supply chain in terms of both distribution and production, with more accurate quantification of premiums by policyholder risk classes, partly as a result of reduced fraud.

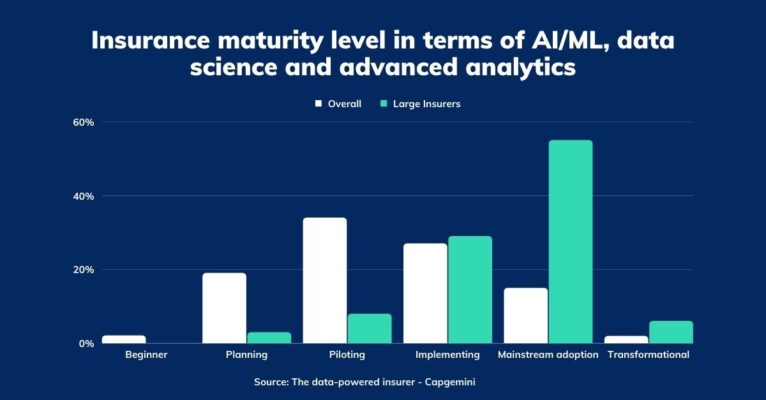

Although the top management of most companies in this sector is aware of these potential benefits, according to data from Capgemini’s latest report, ‘The data-powered insurer: Unlocking the data premium at speed and scale’, only four out of ten insurance companies base their risk selection and pricing process on the information assets available to the company.

Insurance, the AI numbers

An increasingly volatile market, with new entrants coming in from other sectors, changing habits and people’s needs, conditioned by the health emergency, has highlighted how important it is to use data to understand risks, manage them properly and be able to associate the right price with them. Currently, 40% of insurance companies use data to access new markets, while 43% have modernised and enhanced their risk management algorithms.

Insurance companies with non-traditional, real-time data sources, such as those from telematics, wearables and social media, are best placed to meet growing customer expectations for convenience, personalised advice and dynamic pricing, and to compete with InsurTech, which by nature can access personalised insights.

Insurance, data master companies are the best performers

Insurance companies that have structured automated data management and analysis processes are defined by the Insurance report as “Data Masters“, and more than 90% of them reported higher premiums, a better-combined ratio (the main performance indicator in non-life insurance, which indicates the ratio of overheads and claims costs to premium income) and higher Net Promoter Score results than half of their competitors. Three things set them apart from other companies: 92% have centralised governance or a facilitating body, 62% work with InsurTech and 97% have created open APIs (application programming interfaces) that allow third parties to access their data.

Insurance, using data to increase profitability

The report finds that insurance companies are using data to develop new solutions, create value-added services for customers and gain unique insights to understand and price risks. With data, more than 40% of companies are entering new markets, moving from risk protection to risk prevention, as well as transforming actuarial assumptions. In addition, 43% are using real-time data to update their actuarial models, while about a third are using data to simulate new risks.

Many companies are also investing in data in a targeted way, such as modern risk algorithms that can store a wide range of data sources and display them quickly when a decision needs to be made. Over the past two years, some 43% of insurance companies have modernised and upgraded their risk algorithms and, as a result, almost 39% of insurance companies can say that their risk selection and pricing process is based on facts and data.

According to Capgemini, only 18% of insurance companies have the technical capability, culture and practices to support data-driven programmes to make the most of the growing volume of data, and these are usually companies with an average turnover of more than $20 billion.

Insurance, how to enhance risk assessment methods with AI

According to the report, 35% of insurers have gained competitive advantages from investing in data analytics tools, such as increasing premiums written and improving loss ratios. Artificial intelligence has the potential to strengthen existing risk assessment methods, improving them and providing added value, responding to regulations and moving away from indeterministic approaches towards white box methods, i.e. with full traceability of the factors taken into account in the assessment and the outputs that can be obtained. The use of AI techniques applied to Insurance, as in the custom software we develop at Premoneo, has demonstrated its effectiveness not only in risk calculation, but also in other areas, such as Sales & Marketing activities, both in terms of Customer Acquisition and Churn management.