In today’s work landscape, there has been an evolution of roles and, in most companies, even CFOs have changed their work routines in recent years. Until a few years ago, CFOs spent their days poring over stacks of reports analyzing expenses and trends, but now they’ve become more aware of the role technology can play in helping them make strategic decisions, and they’re trying to make the most of it. To be able to accurately forecast trends, CFOs with a more innovative approach has begun to introduce new technologies into their daily activities, such as analytics aimed at optimizing resources and time and making processes more efficient.

CFOs and artificial intelligence to improve valuations

The common point between the analyses carried out both manually and through new technologies by CFOs is the need to have clean data from which to extrapolate relevant information to guide the company in the best choices to grow the business. It is precisely for this objective that artificial intelligence could be adopted during different meetings to provide relevant information to support and accelerate decision-making processes and generate more efficient results. By making better decisions, based not on last quarter’s data, but on updated figures that can describe the real value of the company at that moment, it is possible to reduce management risks and increase profits and ROI on individual projects. In addition, CFOs can also use AI-based technology to train the workforce to automate various processes that can be managed independently by a machine and allocate the skills of team members to high value-added activities and choices.

CFOs and Artificial Intelligence, the research

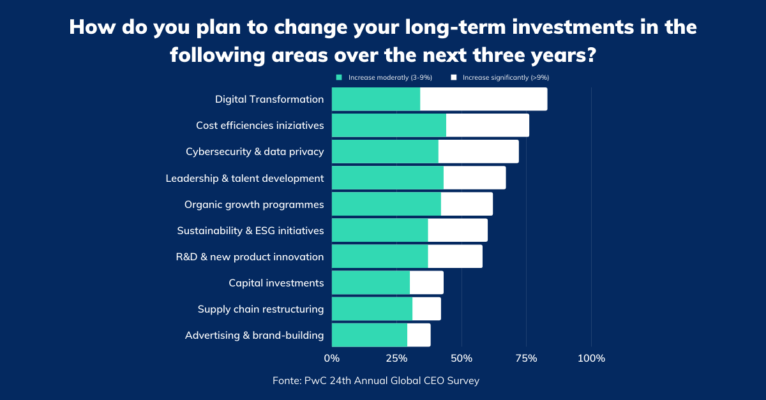

The use of new solutions would bring not only more complex issues on the table to be analyzed, but also to their resolution by optimizing business choices. According to PwC’s 24th Global CEO Survey, following the Covid-19 health emergency, half of the CEOs expect increases of 10% or more in their long-term investment in digital transformation.

CFOs, being among the figures most capable of extracting real business value from data, with the right insights and skills can bring artificial intelligence into their businesses.

CFO and Artificial Intelligence, the main application activities

Here are some concrete examples of application in the activities associated with the role of CFOs:

- Debt and expense forecasting and management: through AI, CFOs can easily forecast both the turnover and the potential income that individual business units can achieve, reasoning also at the level of value generated by each customer. This allows for timely reasoning on current expenses and possible debt renegotiations.

- Fraud detection: through new technologies it becomes easier to detect suspicious expense claims simply by analyzing and interpreting the data, comparing it with past expenses. Through the new tools, it is also possible to anticipate fraud by using machine learning technology to identify and predict employee behaviour.

- Money Laundering Detections: verification of suspicious behaviour and detection of fraudulent activity.

- Pricing control: the most advanced Price Management and Price Optimization software can support in pricing optimization, speeding up and automating the process of price definition and revision.

Artificial intelligence and new software can help CFOs take faster decisions and based on real data, streamlining processes and having a significant upward impact on ROI in the short-medium term.